Help to Buy: ISA

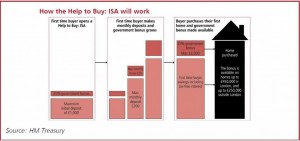

Following the government’s recognition that many hardworking households are unable to get on to the property ladder, action has been taken by introducing the Help to Buy: ISA, which will be available from autumn 2015.

The Help to Buy: ISA will be available through banks and building societies and is designed to reward people who are saving to purchase their first home. First time buyers that choose to save through this ISA will receive a government bonus to help them make the critical step on the housing ladder.

The bonus will represent 25% of the amount saved. The maximum monthly saving is £200, towards which the government will contribute a further £50. The savings will be capped at a maximum of £12,000, towards which the government would contribute a further £3,000, totalling £15,000. The bonus will be calculated and paid when you buy your first home.

Accounts are limited to one per person, rather than per home, so those buying together can both receive a bonus. This means for a couple who save the full £200 per month each and reach the maximum £12,000 per person, will receive a total of £6,000 from the government.

First time buyers can make an initial £1,000 deposit and with the following payments limited to £200 per month, it will take at least four and a half years for savers to reach the £12,000 and qualify for the maximum state top up.

There are divided opinions regarding the ISA scheme. Some believe that it will mainly benefit first-time buyers who already have some money saved for their deposit. Others say it is a generous scheme, as it is over and above any interest rates you could receive on an account.

Experts have predicted that between now and 2020 people may delay purchasing their first property, to be able to get the maximum top up. This could lead to a surge in demand, in around five years time and lead to an increase in property prices at that time.

Likes

Likes